Manage your company spend effortlessly

Business expense cards

- Issue corporate debit cards to team members abroad

- Create custom spend programs and approvals

- Spend in 130+ currencies

- Easily sync your transactions and expenses to accounting tools

Fees and T&Cs apply. Custom spend programs and approvals are available on our Grow, Scale, and Enterprise plans.

Powering team spend for leading businesses

6%¹

saved by our customers

on spend when using Revolut Business

20k+

new businesses

joining Revolut Business monthly

4.9/5

for customer satisfaction

2024 winner of Finder's Business Banking Customer Satisfaction Award UK

¹Based on the average reduction in spending volume for Revolut Business customers when using our spend control features in the first 3 months of 2024. This percentage is illustrative of savings that could be achieved, but is not guaranteed.

Expense cards that mean business

Issue physical and virtual debit cards for you and your team — and get sleek, stainless-steel cards to stand out. Spend securely online, organise expenses, manage subscriptions, and much more.

Fees and T&Cs apply. Metal cards are available on our Grow, Scale, and Enterprise plans.

Get your cards

Employee expense cards made easy

Issue debit cards to team members around the world, and empower them to spend when they need to, while you stay in control.

- Get physical cards for your whole team — up to 3 per employee

- Issue virtual cards instantly — up to 200 per team member

- Access corporate travel cards and spend in 130+ currencies

Fees and T&Cs apply. Each employee's first physical card comes at no cost. Fees apply for additional physical cards.

Open your account

Finance-friendly expense cards

Spend less time chasing receipts and reconciling transactions with our expense management tools.

- Capture receipts on the go — just snap a photo or forward an email, and they’ll be auto-matched to transactions

- Set personalised approval processes, so expenses always reach the right person

- Cut out the manual data entry — easily reconcile expenses by syncing with your accounting software. Learn which accounting tools we integrate with

Fees and T&Cs apply. Custom spend programs and approvals are available on our Grow, Scale, and Enterprise plans. Expenses is available on all plans for an additional fee.

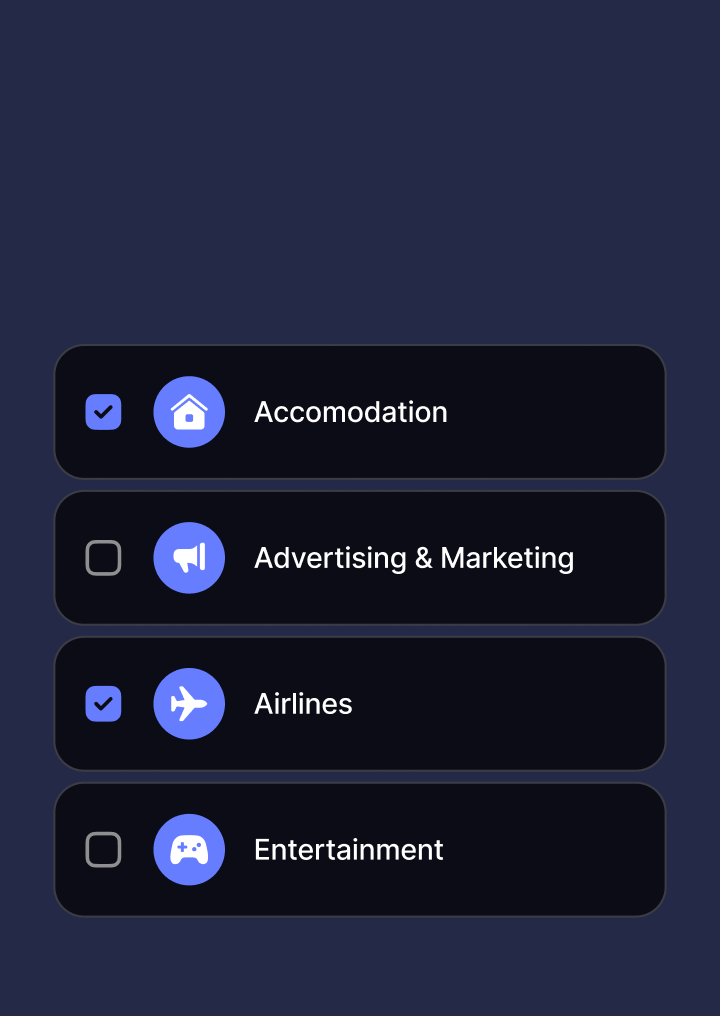

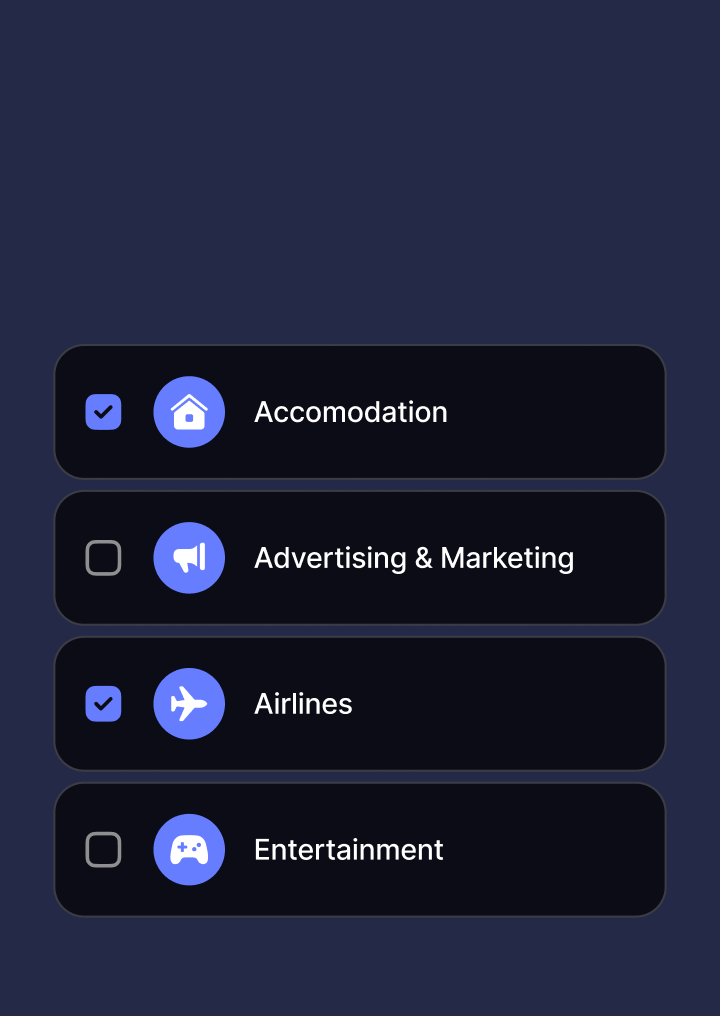

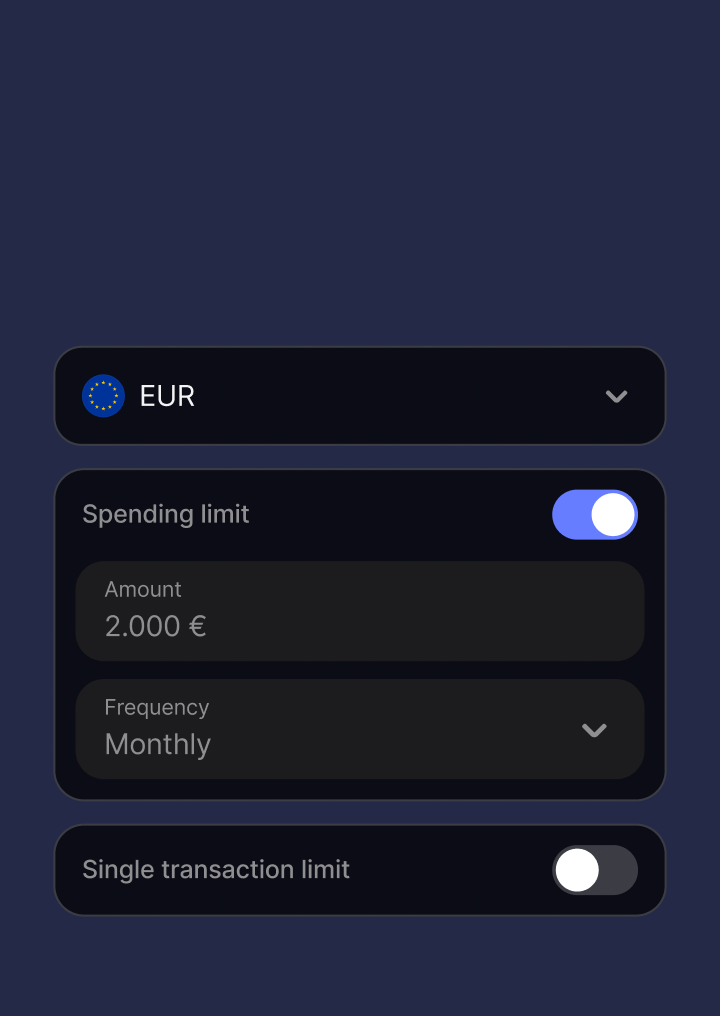

Corporate expense cards you control

Set card controls at every level. Define specific categories, accounts, currencies, spend periods, and more — so spend only happens when and how you want it to.

Custom spend programs and approvals are available on our Grow, Scale, and Enterprise plans.

Set up controls

Luca Carlucci, CEO • BizAway“With Revolut Business, our cards draw directly from our central account with no need to pre-pay. We get an overview of our spend and can send statements directly.”Discover all customer stories

Luca Carlucci, CEO • BizAway“With Revolut Business, our cards draw directly from our central account with no need to pre-pay. We get an overview of our spend and can send statements directly.”Discover all customer stories Denis Smaglo, Group CFO • Ticket Travel Network“Revolut Business is the most reliable, and — most importantly — the least time-consuming card provider in my practice.”Discover all customer stories

Denis Smaglo, Group CFO • Ticket Travel Network“Revolut Business is the most reliable, and — most importantly — the least time-consuming card provider in my practice.”Discover all customer stories Elena Giombelli, CFO • WeRoad“We minimise the use of cash, reconciliation has been streamlined and made more accurate, and we also save money on foreign exchange.”Discover all customer stories

Elena Giombelli, CFO • WeRoad“We minimise the use of cash, reconciliation has been streamlined and made more accurate, and we also save money on foreign exchange.”Discover all customer stories Darach Ellison, EVP Strategy & Finance • Rakuten France“Revolut Business has freed up our teams' card payments, while simplifying and securing financial processes.”Discover all customer stories

Darach Ellison, EVP Strategy & Finance • Rakuten France“Revolut Business has freed up our teams' card payments, while simplifying and securing financial processes.”Discover all customer stories

Get your business expense cards today

Get all the cards and tools you need to manage team spend with Revolut Business. Fees and T&Cs apply. Custom spend programs and approvals are available on our Grow, Scale, and Enterprise plans.

Basic

From €10/monthGet the essentials to run your business.

Grow

From €30/monthUnlock the tools you need to manage spend worry-free.

Scale

From €90/monthAccess higher allowances to expand globally.

Enterprise

CustomCreate the plan that fits your exact needs.

Business expense cards FAQs

A corporate expense card is a credit or debit card that helps businesses control employee spending. Unlike personal credit or debit cards, these business expense cards give organisations direct control over corporate spend. Employees can make business-related purchases without the hassle of personal reimbursements, which streamlines finance team workflows and improves spending transparency.

Our corporate cards are available as physical and virtual debit cards. You can also order stainless-steel Metal cards, available on our Grow, Scale, and Enterprise plans.

Virtual cards are digital payment cards that aren't connected to a physical card. You can create them online, via our web or mobile app, for specific purchases or subscriptions. Having separate card numbers for certain transactions enhances security and increases flexibility when managing your business expenses. You can also set spend limits and cancel cards instantly to reduce the risk of fraud and stay in total control.

With Revolut Business, you can instantly issue up to 200 virtual cards to each of your team members. If you’re handling high transaction volumes, you can also use our API to automatically issue virtual cards — then pay your suppliers instantly, in the exact amount, using their preferred local currency. Our API is available on our Grow, Scale, and Enterprise plans.

You can use business expense cards for a variety of corporate expenses, including:

- office supplies and equipment

- software subscriptions

- travel expenses

- professional training materials

- marketing and advertising costs

- vendor payments

- inventory purchases

- client meeting expenses

With Revolut Business, you can set spending limits and permitted categories — either on an employee level, or at a team level — so you're always in control.

Fees and T&Cs apply. Custom spend programs and approvals are available on our Grow, Scale, and Enterprise plans.

Costs for corporate expense cards vary depending on the provider.

With Revolut Business, you get:

- each employee's first physical card at no cost (delivery fees apply for any additional physical cards — you'll see the full cost per card in-app before you order)

- up to 200 virtual cards per employee for free

- complimentary stainless-steel Metal cards, included on our Grow plan and above (fees apply for additional Metal cards above your plan's allowance)

See our pricing page for more details.

With our employee business expense cards, you get:

- precise spend controls (available on our Grow plan and above)

- real-time transaction monitoring

- simplified expense tracking

- expense reconciliation with less admin

- improved cashflow management

- easy budget allocation

- instant digital receipt collection

Companies often record business expenses by:

- using integrated expense management software

- capturing digital receipts automatically

- categorising expenses

- automating financial reconciliation

- maintaining documentation of processes and tools

Using our business expense cards alongside our analytics and expense management tools can make recording expenses much easier and faster. Our expense management tools are available on all plans at an additional cost. Fees and T&Cs apply.