Revolut 6-17 | Parents and guardians

The account for kids and teens

A Revolut app and debit card for 6-17 year olds. Empower your kid to learn about money, in a parent-supervised space. T&Cs apply.

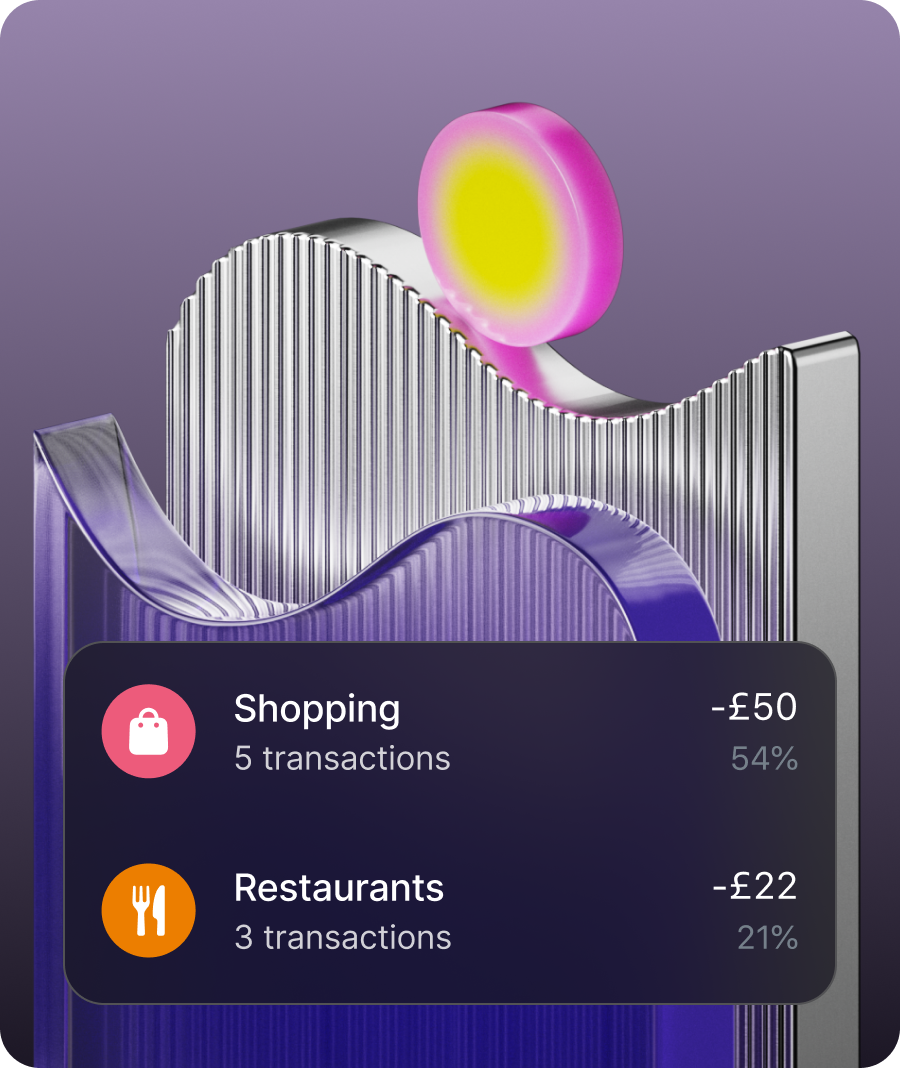

Independence for them, peace of mind for you

Kids get the financial freedom of their own app and card, while you get visibility on your app. From spending limits to in-app card freezing, you’ve got total oversight.

Get Revolut

Cards uniquely theirs

Let your kid’s personality shine through with card customisation. They can use their personalised card to make payments and withdraw from ATMs, even if they’re travelling abroad. Or they can go fully digital with virtual cards and add them to their Apple or Google Wallet.

Customisation and delivery fees may apply. Minimum age applies.

Order their cardReceiving money, from: you

You and your co-parent can set up recurring payments to automate their allowance, giving them a regular 'payday'. Kids and teens can also request money when they need it.Open their account

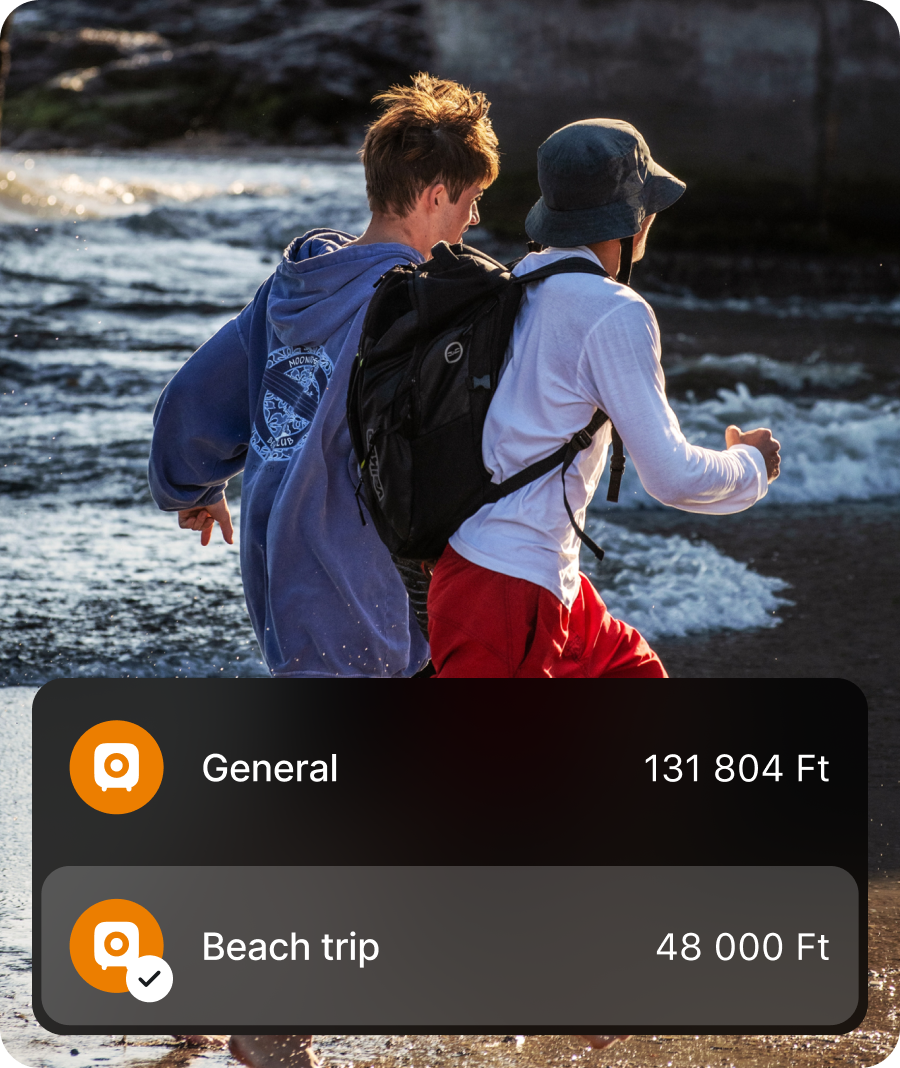

Money, organised

Give your kid the tools to organise money with Pockets. These custom sub-accounts let them set aside money for specific purposes — whether that's a new pair of earbuds, or dinner with friends.Pockets are not savings accounts and do not earn interest.Help them open a Pocket

How to open a kids & teens account

Get the app

Have your kid download the Kids & Teens app and create an account. If they’re 15 or under, you’ll need to create their account from your Revolut app.

Approve

If they’re 16 or over, we’ll send you a notification to let you know it’s time to approve their account from your Revolut app.

And go

Order their card, customise it together (fees may apply), and add it to their Apple or Google Wallet (if they’re old enough).

Kids & Teens accounts are available for ages 6-17, and parent or guardian must be 18+ and have a Revolut account.

Teens aged 16+ can create an account with parent or guardian approval. Payments to and from other customers on Revolut — Kids & Teens are only available to teens aged 16+.

Some products and features are only available for kids above a certain age. See availability in-app or within our FAQs.

FAQs

To open a Revolut — Kids & Teens account, you need to be a legal guardian and have an existing Revolut account.

You can then set up a Kids & Teens account for your kid or teen through your main Revolut app.

Get the Revolut appThey can have a Kids & Teens account when they're between 6-17 years old.

LabelYes, you can open a Kids & Teens account in a few taps directly through the main Revolut app.

It's free for one account, but you'll need to upgrade if you want to include multiple kids, each with their own account. Other fees like personalisation of debit cards may apply. See full information in the T&Cs.

Yes, they can use their Kids & Teens account abroad.

Their card works just like your Revolut card for making purchases online or in person, and for withdrawing money from ATMs, even when overseas.

If your kid or teen makes a purchase in a currency different from the base currency of your Revolut account, the transaction will be converted in the same way as it would be on your own account. The value of foreign exchange allowed before a high-frequency fee applies is less than your own account. See all fee info in the T&Cs.