Colombian currency

Travelling to Colombia? Before you head off, find out all about Colombian currency exchange, including tips on how to save with your Revolut multi-currency card.

What is the currency in Colombia?

Colombia uses the Colombian Peso as its official currency since 1993.

If you’re exchanging money before your trip to Colombia, keep an eye out for the currency code COP, and check out our currency converter to find out how much your money's currently worth in Colombian Pesos.

Once you’re in Colombia, you’ll see the symbol $ used to show prices at shops and restaurants.

Want to pay in cash like a local? You'll find Colombian Peso banknotes in $2000, $5000, $10000, $20000, $50000, $100000. Each Colombian Peso is divided into 100 centavos, with coins in $50, $100, $200, $500, $1000.

Spend in Colombian currency with your Revolut travel card

It's the only travel money card you could need.

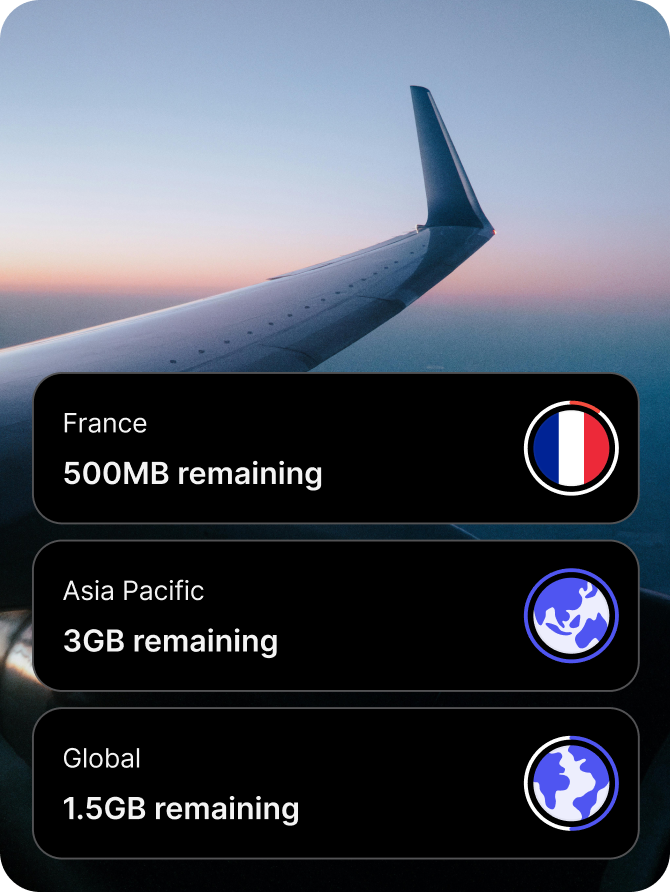

Just add money to your account in any of 36 currencies and pay with your Revolut travel card in Colombia as usual — we'll convert your money to COP for you.

Got another trip coming up? We've got you covered. Use your travel card to pay in 150+ other currencies worldwide. This is a travel debit card you'll want to use again and again.

Check out travel cards

One debit card for all your spending in Colombia

Whether you're withdrawing cash or paying for your morning coffee, make sure to have this wild card up your sleeve while you're out and about in Colombia.

Pay contactless

Link your card to Apple Pay or Google Pay, and race through checkout with just your phone wherever Visa and Mastercard are accepted.

Go contactlessCreate virtual cards

Prefer to go digital? Create up to 30 virtual cards in-app and manage your spending entirely online. Bonus tip — create a disposable virtual card for extra secure online shopping.

Check out our virtual cardsWithdraw cash with no Revolut fees

Find an ATM nearby with our in-app ATM locator and withdraw cash with no fees from us, whenever you're within your plan's limits.

Find an ATM in-appCustomise card security features

Freeze your card in a tap if it goes missing, then unfreeze it when you're ready to start spending again. Now that's security that'll give you the chills.

Explore card securityPay contactless

Link your card to Apple Pay or Google Pay, and race through checkout with just your phone wherever Visa and Mastercard are accepted.

Go contactlessCreate virtual cards

Prefer to go digital? Create up to 30 virtual cards in-app and manage your spending entirely online. Bonus tip — create a disposable virtual card for extra secure online shopping.

Check out our virtual cardsWithdraw cash with no Revolut fees

Find an ATM nearby with our in-app ATM locator and withdraw cash with no fees from us, whenever you're within your plan's limits.

Find an ATM in-appCustomise card security features

Freeze your card in a tap if it goes missing, then unfreeze it when you're ready to start spending again. Now that's security that'll give you the chills.

Explore card security

Withdraw cash in Colombia with no Revolut fees¹

While most shops in Colombia accept Visa or Mastercard, having cash on hand is always a good idea. Embark on all your adventures knowing you've got easy access to ATM withdrawals whenever you need them.

Standard

No Revolut fees on ATM withdrawals up to €200 or 5 withdrawals per rolling month

Plus

No Revolut fees on ATM withdrawals up to €200 per rolling month

Premium

No Revolut fees on ATM withdrawals up to €400 per rolling month

Metal

No Revolut fees on ATM withdrawals up to €800 per rolling month

Ultra

No Revolut fees on ATM withdrawals up to €2,000 per rolling month

¹After you reach your monthly limit, you'll pay a 2% fair usage fee. Third-party ATM fees may also apply.

Your top money savers

Tips for exchanging money in Colombia

Don't exchange at airports or at home

No need to overspend on exchanging cash before you travel. Use your Revolut card to spend or withdraw money from an ATM while you're in Colombia (just watch out for third-party ATM fees).

Choose the local currency

While you're in Colombia, always choose to pay in Colombian Pesos when you spend with your card in shops and restaurants. This'll help you avoid dynamic currency conversion (DCC) fees.

Save on travel money with a Revolut card

Spend in Colombian Pesos at competitive rates on your next trip to Colombia, with no additional currency exchange fees on weekdays within your plan's limits. Plan fees and T&Cs apply.

Exchange to Colombian currency with Revolut

Whether you're sending or spending abroad, we've got something for you.

Convert EUR to COP

Check out our EUR to COP currency converter to see how much your EUR is worth in COP with our exchange rates and fees.

Transfer money to Colombia

Send money to Colombia in just a few taps. We'll handle the currency exchange for you.

Spend in COP

Taking a trip to Colombia? Get our Revolut Travel Money Card and spend like a local, with competitive exchange rates and fees.

A need for Colombian currency?

Convert your money into COP

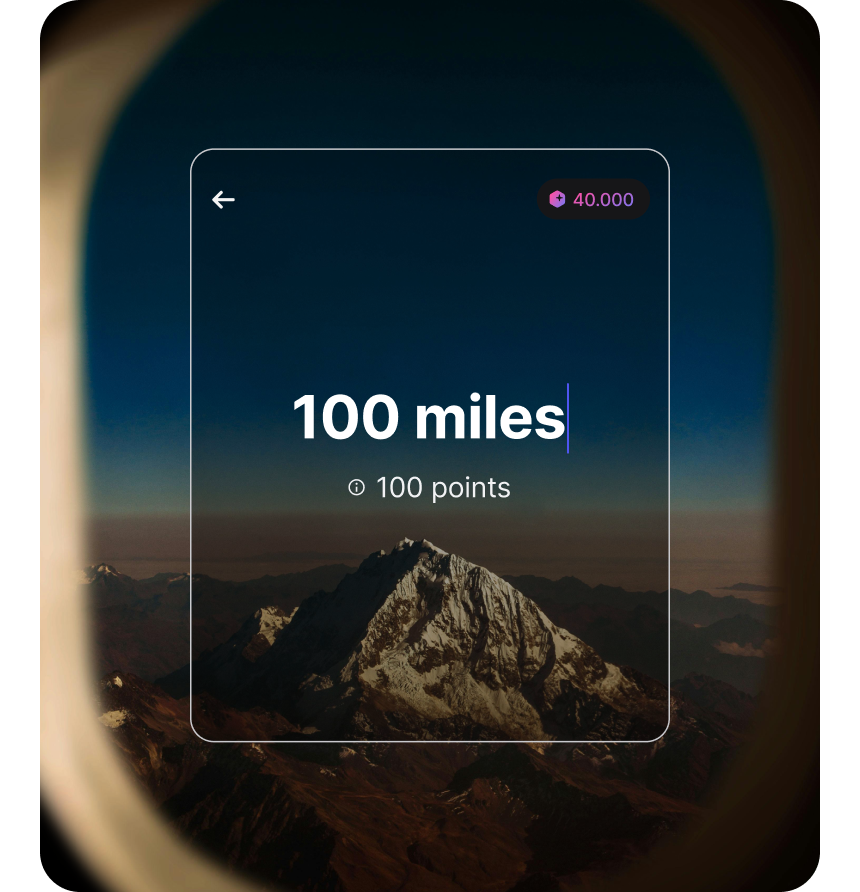

Exchange, send, and spend directly in Colombian currency in-app with rates you'll love. Check out our live foreign exchange rates with our currency converter and see for yourself why 65+ million global customers use Revolut.

Colombian Currency Exchange Rate

1 EUR = 4,305.9120 COP

-$317.366.86 %Save on travel spend

Pay no midweek exchange fees², and get up to €2,000 in free monthly ATM withdrawals abroad.Travel with Revolut

²Available on our Premium, Metal, and Ultra plans. A fair usage limit applies to other plans. Paid plan fees and T&C apply.

Pick your next destination

Most popular currency guides

Colombian currency FAQs

- Like all cities in Colombia, Bogota uses the Colombian Peso as its official currency. Each Colombian peso is divided into 100 centavos. While you're in Colombia, you’ll see the symbol $ in shops and restaurants. If you're exchanging currencies, keep an eye out for the currency code COP.

Yes, you can use your Revolut card at shops, restaurants, and hotels in Colombia that accept Visa and Mastercard.

All you have to do is add money to your account in any of our 36 supported currencies and pay with your card as usual. We'll automatically exchange to COP at the Revolut exchange rate. You can also make ATM cash withdrawals in Colombian Pesos with your multi-currency card. You won't pay any Revolut ATM fees if you're within your plan's monthly fair usage limits:- Standard: up to €200 (or 5 withdrawals, whichever comes first)

- Plus: up to €200

- Premium: up to €400

- Metal: up to €800

- Ultra: up to €2,000

These limits are set on a rolling monthly basis. This means they'll reset every month from the date you opened your account or the date you changed your plan. You can check your remaining monthly allowance in-app.

Check out our Help Centre for more on ATM withdrawal limits.

When you use your card in Colombia, you'll often be asked whether you want to pay in Euros. This is called dynamic currency conversion (DCC). While it may make it easier to understand exactly how much you're paying in your home currency, you'll often get a poor exchange rate and pay additional fees.

Our go-to tip? When you're in Colombia, always choose to pay in the official Colombian currency: the Colombian peso.

When you spend with your Revolut debit card, we'll take care of the currency exchange, so you'll get competitive rates and fees.Here's how you can get your Revolut Travel Money Card:

- Download our app for iOS or Android, and sign up for an account in just a few minutes

- Tap the card icon on your home screen, go to + Add new, and choose whether you want a physical card, a virtual card, or both

- Add money to your account in any of 36 supported currencies

- Start spending online and in shops with your virtual card straight away. We'll handle the currency conversion for you

- Once your physical card arrives, you can start making ATM withdrawals as well

Currency exchange rates rise and fall constantly, so it's wise to keep an eye out for current market trends.

Before converting Euro to Colombian peso, use our currency converter, conversion tables, and price comparison widget to find today's exchange rates and compare different providers. Keep in mind that exchange rates fluctuate constantly, so always double-check our current rate in-app before converting.

Check live Euro to Colombian peso exchange rates now.

When you're in Colombia, you have several convenient ways to handle your payments with Revolut.

Your multi-currency card is widely accepted at most merchants, allowing you to pay directly in Colombian peso if you have it in your account, or automatically converting from another currency in your balance at competitive exchange rates.

For cash needs, you can easily withdraw Colombian peso from ATMs, keeping in mind your plan's withdrawal limits.

Additionally, if you've added your Revolut card to Apple Pay or Google Pay, you can often use your phone for contactless payments at participating stores and restaurants, offering a quick and secure way to pay.

Adding Colombian peso to your Revolut account is straightforward.

- Go to 'Home' on the bottom menu

- Below your balance, tap 'Accounts'

- Tap 'Add new'

- Choose 'Currency account'

- You'll see a list of the available currencies to choose from

- Follow the steps in-app to set up your additional currency account